Standard Deduction 2022 Explained . The standard deduction and itemized deductions. the standard tax deduction is a fixed amount that the tax system lets you deduct from your income, no questions asked. the standard deduction is a popular way for taxpayers to reduce the amount of income they are taxed on. there are two main types of tax deductions: the standard deduction is a flat amount that reduces your taxable income and potentially your tax bill. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the standard deduction amount for the 2022 tax year jumps to $12,950 for single taxpayers, up $400, and $25,900 for a married. The amount typically increases each year with inflation,. The irs allows you to claim one type of. How much of a deduction you're entitled. the standard deduction is a dollar amount that you can deduct from your taxable income.

from dxojmkgxy.blob.core.windows.net

The irs allows you to claim one type of. the standard deduction is a popular way for taxpayers to reduce the amount of income they are taxed on. How much of a deduction you're entitled. there are two main types of tax deductions: The amount typically increases each year with inflation,. the standard deduction amount for the 2022 tax year jumps to $12,950 for single taxpayers, up $400, and $25,900 for a married. the standard deduction is a dollar amount that you can deduct from your taxable income. the standard tax deduction is a fixed amount that the tax system lets you deduct from your income, no questions asked. the standard deduction is a flat amount that reduces your taxable income and potentially your tax bill. The standard deduction and itemized deductions.

Standard Deduction 2022 Single Over 65 at Jenny McGriff blog

Standard Deduction 2022 Explained the standard deduction is a popular way for taxpayers to reduce the amount of income they are taxed on. the standard deduction amount for the 2022 tax year jumps to $12,950 for single taxpayers, up $400, and $25,900 for a married. the standard deduction is a dollar amount that you can deduct from your taxable income. the standard tax deduction is a fixed amount that the tax system lets you deduct from your income, no questions asked. The amount typically increases each year with inflation,. The irs allows you to claim one type of. there are two main types of tax deductions: the standard deduction is a popular way for taxpayers to reduce the amount of income they are taxed on. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. The standard deduction and itemized deductions. the standard deduction is a flat amount that reduces your taxable income and potentially your tax bill. How much of a deduction you're entitled.

From giolwzmux.blob.core.windows.net

Standard Deduction 2022 Vs 2021 at Frank Witcher blog Standard Deduction 2022 Explained How much of a deduction you're entitled. the standard deduction amount for the 2022 tax year jumps to $12,950 for single taxpayers, up $400, and $25,900 for a married. the standard deduction is a dollar amount that you can deduct from your taxable income. the standard tax deduction is a fixed amount that the tax system lets. Standard Deduction 2022 Explained.

From soniapaige.pages.dev

Standard Tax Deduction 2025 Married Jointly Under 80c Sonia Paige Standard Deduction 2022 Explained the standard deduction is a flat amount that reduces your taxable income and potentially your tax bill. The standard deduction and itemized deductions. the standard deduction is a dollar amount that you can deduct from your taxable income. How much of a deduction you're entitled. the standard deduction amount for the 2022 tax year jumps to $12,950. Standard Deduction 2022 Explained.

From gioqurlew.blob.core.windows.net

Standard Deduction 2022 For Married Filing Jointly at Louis Silva blog Standard Deduction 2022 Explained the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the standard deduction is a flat amount that reduces your taxable income and potentially your tax bill. there are two main types of tax deductions: the standard deduction is a popular way for taxpayers to reduce the amount. Standard Deduction 2022 Explained.

From hindkunj.com

Standard Deduction 2022 IRS Hindkunj Standard Deduction 2022 Explained the standard deduction is a popular way for taxpayers to reduce the amount of income they are taxed on. the standard tax deduction is a fixed amount that the tax system lets you deduct from your income, no questions asked. The irs allows you to claim one type of. the standard deduction is a flat amount that. Standard Deduction 2022 Explained.

From katleenwgerty.pages.dev

What Is The Standard Deduction For 2024 For Over 65 Perri Brandise Standard Deduction 2022 Explained the standard deduction is a dollar amount that you can deduct from your taxable income. the standard deduction is a popular way for taxpayers to reduce the amount of income they are taxed on. the standard deduction amount for the 2022 tax year jumps to $12,950 for single taxpayers, up $400, and $25,900 for a married. . Standard Deduction 2022 Explained.

From hxehopzjh.blob.core.windows.net

Nevada Standard Deduction 2022 at Melissa Whitaker blog Standard Deduction 2022 Explained the standard deduction is a dollar amount that you can deduct from your taxable income. The standard deduction and itemized deductions. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. How much of a deduction you're entitled. The irs allows you to claim one type of. there are. Standard Deduction 2022 Explained.

From www.wsj.com

Standard Deduction 20222023 How Much Is It and Should I Take It? WSJ Standard Deduction 2022 Explained The amount typically increases each year with inflation,. the standard tax deduction is a fixed amount that the tax system lets you deduct from your income, no questions asked. The standard deduction and itemized deductions. the standard deduction is a dollar amount that you can deduct from your taxable income. there are two main types of tax. Standard Deduction 2022 Explained.

From dolado2icmaterialdb.z13.web.core.windows.net

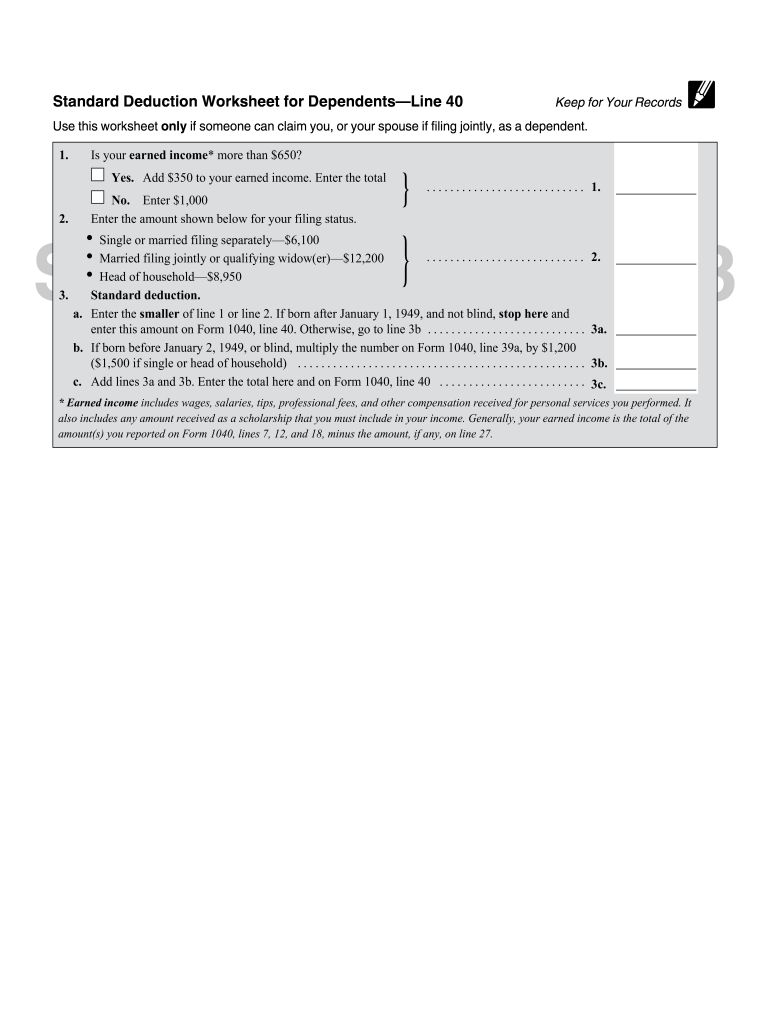

2021 Standard Deduction Worksheets Standard Deduction 2022 Explained there are two main types of tax deductions: the standard deduction is a popular way for taxpayers to reduce the amount of income they are taxed on. the standard tax deduction is a fixed amount that the tax system lets you deduct from your income, no questions asked. the standard deduction is a dollar amount that. Standard Deduction 2022 Explained.

From giovannawdavina.pages.dev

New Standard Deductions For 2025 Sher Ysabel Standard Deduction 2022 Explained the standard deduction is a flat amount that reduces your taxable income and potentially your tax bill. the standard deduction is a popular way for taxpayers to reduce the amount of income they are taxed on. The irs allows you to claim one type of. the standard deduction is a dollar amount that you can deduct from. Standard Deduction 2022 Explained.

From dotiykissee.pages.dev

What Is Standard Tax Deduction For 2025 Val Libbie Standard Deduction 2022 Explained The irs allows you to claim one type of. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the standard deduction is a flat amount that reduces your taxable income and potentially your tax bill. How much of a deduction you're entitled. the standard deduction amount for the. Standard Deduction 2022 Explained.

From dacybjosephine.pages.dev

Irs Standard Deduction For Seniors 2024 Dian Murial Standard Deduction 2022 Explained there are two main types of tax deductions: the standard deduction is a dollar amount that you can deduct from your taxable income. The amount typically increases each year with inflation,. the standard deduction is a flat amount that reduces your taxable income and potentially your tax bill. How much of a deduction you're entitled. The standard. Standard Deduction 2022 Explained.

From katleenwgerty.pages.dev

What Is The Standard Deduction For 2024 For Over 65 Perri Brandise Standard Deduction 2022 Explained How much of a deduction you're entitled. the standard deduction is a flat amount that reduces your taxable income and potentially your tax bill. there are two main types of tax deductions: The amount typically increases each year with inflation,. the standard deduction is a dollar amount that you can deduct from your taxable income. the. Standard Deduction 2022 Explained.

From printablefullminis.z13.web.core.windows.net

Standard Deduction 2022 Worksheet Standard Deduction 2022 Explained the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. The standard deduction and itemized deductions. The irs allows you to claim one type of. the standard tax deduction is a fixed amount that the tax system lets you deduct from your income, no questions asked. the standard deduction. Standard Deduction 2022 Explained.

From www.humaninvesting.com

2022 tax updates and a refresh on how tax brackets work — Human Investing Standard Deduction 2022 Explained the standard tax deduction is a fixed amount that the tax system lets you deduct from your income, no questions asked. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. there are two main types of tax deductions: the standard deduction is a popular way for taxpayers. Standard Deduction 2022 Explained.

From delqjoellyn.pages.dev

Standard Business Deduction 2024 Single kym letitia Standard Deduction 2022 Explained The standard deduction and itemized deductions. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the standard deduction amount for the 2022 tax year jumps to $12,950 for single taxpayers, up $400, and $25,900 for a married. there are two main types of tax deductions: How much of. Standard Deduction 2022 Explained.

From giolwzmux.blob.core.windows.net

Standard Deduction 2022 Vs 2021 at Frank Witcher blog Standard Deduction 2022 Explained the standard deduction amount for the 2022 tax year jumps to $12,950 for single taxpayers, up $400, and $25,900 for a married. The irs allows you to claim one type of. the standard tax deduction is a fixed amount that the tax system lets you deduct from your income, no questions asked. the standard deduction is a. Standard Deduction 2022 Explained.

From marketstodayus.com

Understanding the Standard Deduction 2022 A Guide to Maximizing Your Standard Deduction 2022 Explained the standard deduction amount for the 2022 tax year jumps to $12,950 for single taxpayers, up $400, and $25,900 for a married. How much of a deduction you're entitled. The standard deduction and itemized deductions. the standard deduction is a dollar amount that you can deduct from your taxable income. The amount typically increases each year with inflation,.. Standard Deduction 2022 Explained.

From www.taxuni.com

Standard Deduction 2022 Every Filing Status Standard Deduction 2022 Explained the standard deduction is a flat amount that reduces your taxable income and potentially your tax bill. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. The irs allows you to claim one type of. there are two main types of tax deductions: the standard deduction is. Standard Deduction 2022 Explained.